tax on unrealized gains india

Tax Breaks under section 80c to 80U is not available to Capital gain Income. 17472 percent for a domestic company.

Strategies For Investments With Big Embedded Capital Gains

It is a profitable position that has yet to.

. If you buy crypto and it goes stratospheric there could be a new 20 tax rate if you are worth more than 100. Answer 1 of 7. The budget proposes that households worth more than 100 million pay at least 20 in taxes on both income and unrealized gains-- the increase in an unsold investments value.

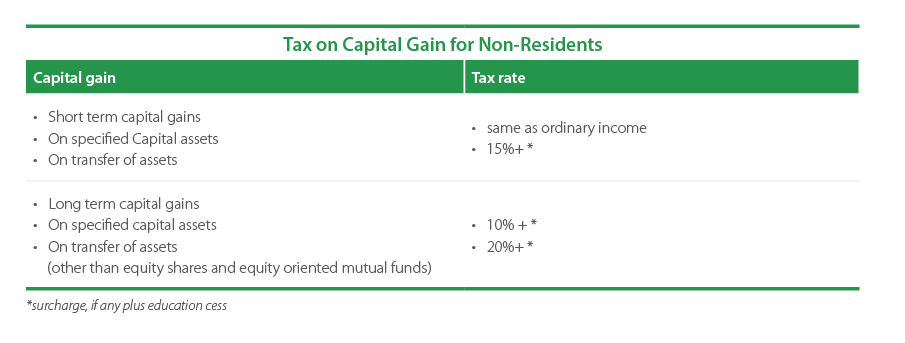

The tax rate on profits realised on the sale of these shares would be determined by whether the shares are long or short term. 4368 percent for a foreign company. It is also clarified that unrealized gainslosses shall be considered net of the effect of taxation.

The long-term capital gains LTCG tax rate is 20 if the holding period is more than 24 months with indexation benefit 2. 1KHR 4000 to another exchange rate eg. An unrealized gains or losses are also called a paper profit or paper loss because it is recorded on accounting systempaper but has not actually been realized.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of. You dont actually pay taxes for unrealized gains you pay taxes based on the taxable value of the property. A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v.

In the second example those are unrealized gains because while youre currently up 10 over your investment if the. Capital gains tax in India Important rules to be aware of. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain.

The Unrealized Exchange Gainloss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added in case of loss or taxed in case of gain since Section 43A treats the same on. Lets say you bought a house at 500000 a decade ago and now its valued at 2 million. If the value drops to 190000 you have a 10000.

This can vary from high to none based on the. Tax saving us 80C to 80U is not allowed to Capital gains. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this.

Yellen had first proposed the tax on unrealised capital gains in February 2021. In total 215 billion could be collected over nine years with. The government provides services for property not stocks.

Requiring investors to pay taxes annually on their unrealized gains would end a longstanding rule that says levies arent due to the IRS unless an asset is sold. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Under Bidens plan you would be asked to pay Uncle Sam 20 on the gainseven if you had no intentions of selling your house.

The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act 1961. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of the sale of the asset. A new tax could require the wealthy to pay least 20 even on unrealized appreciation.

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates. Houses Are Subject To Capital Gains Tax Just Like Stocks. If after such offset and netting with unrealised gainslosses on other financial instruments there are still net unrealised gains the same should be excluded from regulatory capital as required by paragraph 3 of the annex to the said circular.

Income computation and disclosure standards ICDS The CBDT has notified ten ICDS to be followed by all taxpayers that follow the mercantile system of accounting for the purpose of computation of income chargeable to income tax under the head profits and gains of business or profession or income from other sources and not for the purpose of maintenance. If the transaction is subject to STT short-term capital gains arising on transfers of equity shares are taxed at the following rates. The following is the tax rate on the selling of unlisted shares.

Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone. An unrealized gain is a profit that exists on paper resulting from an investment. So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a 10 gain.

1638 percent for a foreign company or FII. If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same.

To know more about the taxability of mutual funds check here - Taxation of Mutual Funds for FY 2021-22 AY 2022-23. This expenditure is a temporary difference for deferred tax purpose hence needs to be accounted for calculation of deferred tax. 13 May 2009 Unrealised gains since belong to a loan taken for purchase of capital assets the same will be charged to P L Account as per As 11 Before amendment and as per tax the same would not be allowed.

You only adjusted from exchange rate eg. For example your pocket cash is USD it is still USD. The first example is realized because you sold the stock for 1100.

So you realized a 10 gain.

How Return Of Capital Can Enhance After Tax Etf Distributions Nasdaq

Strategies For Investments With Big Embedded Capital Gains

What Is Capital Gain Tax Of Capital Gains In India Fincash

What Is Capital Gains Tax Quora

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Do I Need To Pay Tax On Purchasing A Mutual Fund Quora

Capital Gains Tax In India An Explainer India Briefing News

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

How Return Of Capital Can Enhance After Tax Etf Distributions Nasdaq

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

How Are The Gains From Foreign Stocks Taxed In India Quora

Strategies For Investments With Big Embedded Capital Gains

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

Rsu Of Mnc Perquisite Tax Capital Gains Itr

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium